Skyrocket your online business with India’s smartest payment router

- eCommerce

- Food & Grocery

- BFSI

- Travel

UPI and credit alone contribute to 85%+ of your ecommerce payments. Paytm AI Router provides you a definite edge with access to the widest range of UPI & Credit payment options while also providing a seamless & fail-proof payment experience on cards.

- Seamless UPI payments via UPI SDK, UPI Intent & more with instant account-linking experience for 350 Mn+ registered Paytm users.

- Offer all leading credit payment options such as EMI, Cards & BNPL aggregated in one place

- Experience lightning-fast card payments with features like CVV-less card payments, Native OTP, Guest checkout and more

- Prevent payment failures even during peak traffic on sale days

Frictionless payment is one of the most important criterias behind the success of your food & grocery business. A failed payment results in cart abandonment and lost customers.

Paytm AI Router can help you achieve customer satisfaction by increasing payment success rates.

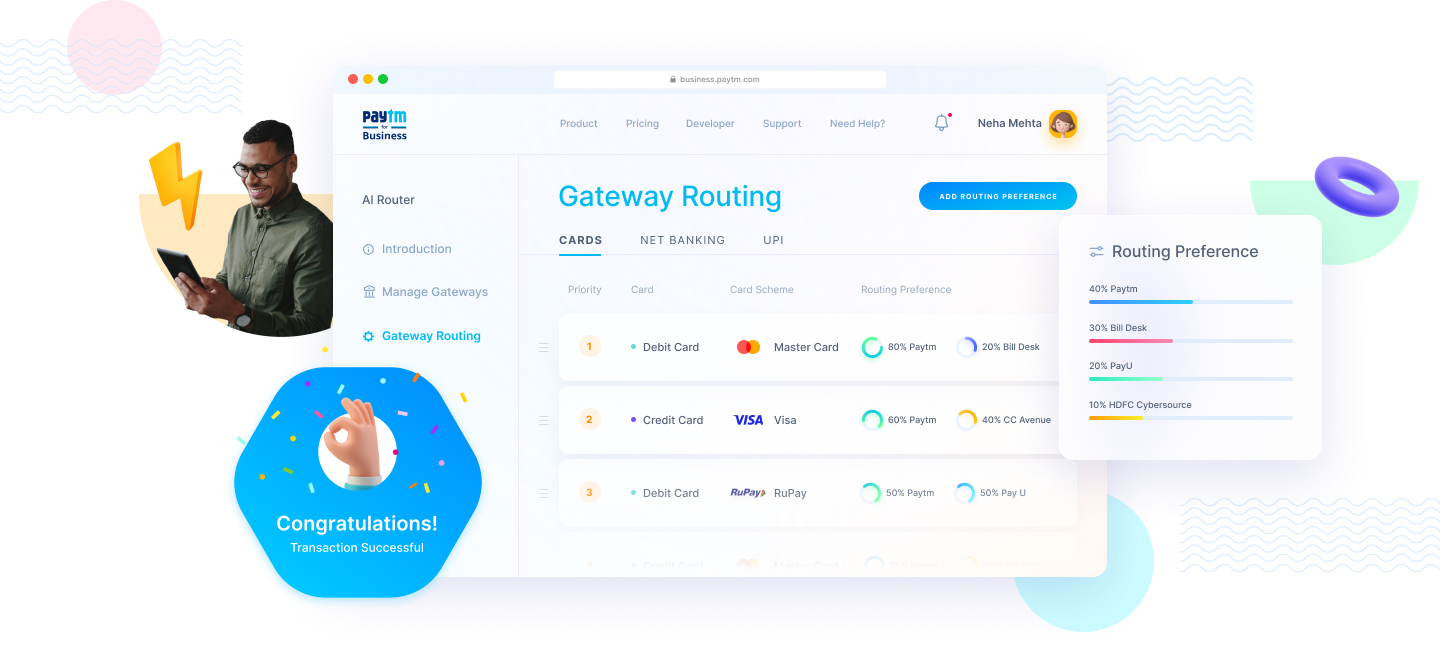

- Flexibility to change your payment routing strategy instantly and set up new rules in seconds from our easy to use dashboard.

- Boost success rates by up to 15% with AI based routing system

- Save costs (transaction, engineering etc.) by easily setting up multiple payment providers

Your BFSI business needs to process large volumes of payments every day. Maintaining multiple payment gateways in order to ensure successful payment acceptance can be an expensive and complex affair.

Routing payments through Paytm AI Router can help reduce costs and complexity while ensuring high payment success rates.

- Increase your revenue and profits by improving conversion even during peak traffic

- Reduce cost on every transaction with cost-based routing

- Improve customer experience with AI-based payment routing

We understand the evolving needs of your online travel business. Given the high ticket sizes, frequent payment failures and chargebacks can have a devastating impact on revenues and erode customer trust.

Your payment systems also need to be robust and support surges in traffic during peak seasons

Paytm AI Router empowers you to offer a seamless payment experience for consumers by

- Enable payment acceptance across app, web & payment links

- Increase conversion through bank offers & EMI

- Ensure up to 10% higher success rates even during peak traffic

Frequently Asked Questions

Get in touch

Sorry

We are experiencing some issues. Please try again later