The Indian e-commerce market has grown at an unprecedented rate in the last two years. As per statistics, it is expected to grow to US$ 111.40 billion by 2025 and then continue its march towards the US$ 350 billion mark by 2030.

While there are several triggers behind these growth numbers, including increased smartphone and Internet penetration, the resulting need is for businesses to level up their game for online selling. Both small and big Indian businesses need the best-in-class payment solution to fulfil the demands of the third-largest online shopper base (140 million) in the world.

If you want to start an online business or transform your local store for online selling, you long for nothing but the best payment gateway. It is because ensuring a smooth payment experience for your customers is the key to continued growth.

One of the most important things you need is a feature-filled payment gateway to start accepting payments online.

Let us help you understand certain aspects related to payment gateways to make an informed decision.

Why are there several payment gateways available in India?

If you can find local stores similar to yours, you can easily understand this question.

Why do they exist when you are selling the same products in the same market?

The answer – there is a demand for products in your region, which implies an opportunity for consistent growth and profitability.

The Indian payment gateway market reached a value of US$ 780 million in 2020 and is expected to grow at a CAGR of 19% from 2021 t0 2026. It is fairly segmented and caters to businesses of all sizes – mid-size enterprises, MSMEs, and large enterprises. As per the forecast, it is expected to reach US$ 1.71 billion by 2025, which shows a big opportunity for payment gateway providers.

Source: Statista

In simpler words, if you would see that the demand for a product in a specific market is growing and will grow further in the coming years, you would want to sell that product to get your share of the profit pie.Various payment gateway providers are doing the same.

However, what matters the most to you, as a payment gateway user, is to find the best payment gateway to support your business needs. This takes us to the next step in payment gateway selection – comparison.

How to select the best payment gateway: Comparative analysis

Payment gateway comparison is about diving deep into the benefits and features of different payment gateways. Ultimately, as a business owner, you want to ensure that no payment-related hassles happen to your target customers.

By comparing payment gateways, you will be able to:

- Find out different features they have

- Consider their benefits specific to your business

- Understand what to look for in the best payment gateway in India

- Assess recommendations from peers in a rational manner

- Create a checklist of factors to consider while choosing a payment gateway

Also Read: Payment Gateway Comparison: Know How to Make the Right Selection

Best payment gateway – What can you expect?

You probably have some ideas about the need for a reliable online payment gateway. Let’s put them into words here:

Easy integration and instant activation

When you are excited about launching your online business or want to transform the traditional one digitally, you do not want any delay.

That’s why you want the payment gateway integration process to be quick and hassle-free. Post integration, the payment gateway allows instant activation, given the continued pandemic situation and the urgent need for business survival.

Wide range of payment methods

While some of your online customers might want to pay you via UPI, others would prefer using a credit or debit card or wallets like Paytm Wallet. Hence, you need the best payment gateway to support almost every popular payment method available out there.

High success rate

Payment failures often result in cart abandonment and loss of potential customers. The last thing you would want the customers to experience is a failed payment and the resulting inconvenience related to the shopping experience.

This is why you look for the best payment gateway that can ensure a high success rate.

You May Also Like to Read: Tokenisation and Its Impact on Online Payments

Suitability for both website and mobile application

Like most businesses, you might want to have an omnichannel presence and sell through both websites and apps. To support the payment needs, you would want the chosen payment gateway to work well in both cases.

Want a statistical view of this need?

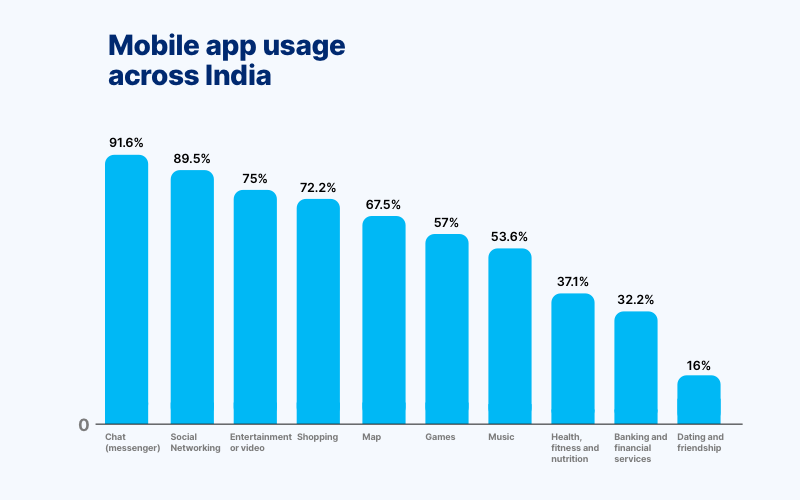

India is a mobile-first market, with over 19 billion mobile apps downloaded in the year 2019. You would certainly want to target these mobile users with the right payment gateway in India.

Mobile Usage Stats – Q3 of 2020

Bank offers and EMIs for customers

‘10% flat discount on ABC credit cards?’, ‘5% cashback on total spend using XYZ card’, ‘Easy EMI solution for purchase above INR. XXX’, etc.

Most consumers get such bank offers and EMIs with products they buy online. How will you offer the same?

It is possible with the right selection of the best payment gateway to let the sales soar along with customer loyalty.

Business statistics

During the pandemic or otherwise, you would want to view or manage settlements, initiate refunds, and look into the detailed reports for the business. Hence, your payment gateway should provide comprehensive reports for everything related to payments.

Best payment gateway vs. free payment gateway

A common dilemma you might face while selecting a payment gateway is whether to find the best payment gateway or start with a free one.

As a matter of fact, you should know that there is no free payment gateway available in India. Irrespective of the payment solution provider, you have to pay different payment gateway charges, including MDR, set up fee, or processing fees.

The ideal solution for your business is to find the best payment gateway that asks for the least charges (at least 0% MDR on UPI and Rupay card payments.

You May Also Like to Read: Free Payment Gateway in India: Busting the Myth

Paytm Payment Gateway – the frontrunner in the race of Indian payment gateways

Being touted as one of the best payment gateways in India, Paytm Payment Gateway is highly preferred by businesses of all sizes – small or big. Some of the biggest brands in India rely on Paytm Payment Gateway to accept online payments.

The reason is – its hi-tech payment technology that also supports the Paytm app.

Wondering why it is the best payment gateway in India? Continue reading.

Features that make Paytm Payment Gateway the best Payment Gateway in India

Here are some of the most impressive features of Paytm Payment Gateway:

- Robust APIs and SDKs for quick integration

- 100% online onboarding with instant activation

- Widest range of payment methods (credit card, debit card, Paytm Wallet, Paytm Postpaid, UPI, and more)

- Industry-best success rate backed by intelligent routing

- 250 million+ saved cards

- 100 million+ saved bank accounts

- 15 million saved UPI IDs

- Powerful dashboard for real-time business analytics and many other functions

- Bank offers and an easy EMI for your customers

Also Read: Paytm Postpaid – Enabling New to Credit Users to Shop Online

Paytm Payment Gateway Vs other Payment Gateways – Comparison

| Evaluating Factor | Paytm Payment Gateway | Other Payment Gateway |

| Success rate | Highest (driven by in-house banking infrastructure) | Comparatively lower because of the dependence on external banking partners |

| Pricing | Lifetime free for UPI and RuPay | 2% charged on UPI & RuPay |

| Settlement Process | T + 1 settlements, no delay on holidays | T + 2; delayed settlements on holidays |

| Payment Handling Capacity | 3,000 transactions per second | Apx. 1000 transactions per second |

| Support for International Payments | Available for 200+ countries | Available for lesser countries |

| Exclusive Benefits for Startups | Free Payment Gateway, Payouts, along with distribution and customer acquisition benefits (T&C applied) | No exclusive solution |

**T = Date of transaction

Best payment gateway – FAQs

| Questions | Answer |

| Which online payment gateway is the best one in India? |

Paytm Payment Gateway |

| Which is the most affordable payment gateway for Indian businesses? | |

| Which payment gateway is the most popular for different types of startups in India? | |

| Which is the safest & best payment gateway in India? | |

| How should I start accepting online payments for my business? |