For businesses to survive and thrive in the long run, having their cash flow and finances in order is paramount. However, for merchants managing payments can be more overwhelming and complicated than it seems. There are various tools, software, and applications that help merchants operate their businesses efficiently. The problem is that merchants often fail to identify the resources that are right for their businesses.

Paytm has come with its new product offering, iCollect that leverages VANs or Virtual Account Numbers for efficient bank transfers and payment reconciliations. Now, you must be wondering what are VANs and how they can make your life easy?

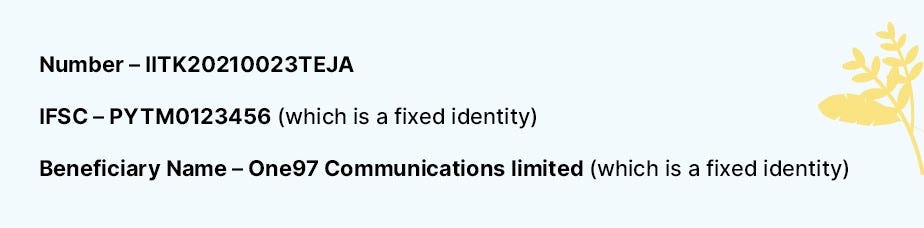

A VAN is 16 digits (alpha-numeric) secure virtual account number that is generated when a merchant authorizes a customer transaction. Generally, a VAN looks something like:

VAN bank transfers ensure a smooth reconciliation process making it easier for the merchants to track back the payments from their customers. Paytm iCollect allows merchants to receive such customer payments.

Example — Let us assume IIT Kanpur wants to collect VANs for its students. Hence, a sample VAN should appear as “10IITK20210023TA”. Here, 20210023 is a unique Roll Number of each student in the institute and TA is the first letter of the first and last name of the student. This way a student will always remember the VAN corresponding to which the payment needs to be made.

With merchants embracing digital innovations as they come — be it in terms of accepting digital payments or implementing new digital applications — the decision to adopt Paytm iCollect to leverage VAN bank transfers is going to be a smart move. It is easy to foresee and understand this growth due to the benefits and ease they provide.

How does VAN transfers benefit your business?

It is crucial for any business to be secure, have efficient operations, and hold a tighter control over the operations. These are the three key benefits that VAN transfers offer merchants.

Security

One of the biggest advantages of adopting VAN transfers as a payment method is the enhanced security that it offers. Regardless of where a company is based in the world, payment fraud is a concern no one can ignore because it can cause a business’s finances to go down the drain. Although frauds can happen due to vulnerabilities in numerous payment modes, the number of cases observed is quite huge for transactions that do not require a card.

VANs are suitable for one-time as well as multiple payments. Yes, customers can make multiple payments to the same VAN allotted to them by the merchants. Merchants can enable and disable a virtual account number as per their needs, and this also helps in reducing the risks of fraud. Even if fraudsters catch hold of a VAN, the threat is limited since merchants can disable it as soon as they get to know about it.

Efficiency

When compared with traditional payment methods, VANs prove to be more efficient, and businesses are quick to realize this fact. Virtual account numbers have an automated audit trail, and they remove the requirement of any manual labor, thereby reducing the workload on resources who can dedicate their time to other business-critical activities. Also, by integrating VAN with the existing business tools, the merchant does not require any particular software to track and reconcile payments for its business.

On top of this, VANs also have comprehensive transaction details. Unlike other wire transfer transactions, they do not come with any space limitation. It allows the business to have all remittance information they require. It also helps in a faster reconciliation process and cuts down the manual resources needed.

Control

As explained earlier, VANs are single-use in nature and hence, provide businesses a tighter control over their expenditures. For instance, with a corporate credit card, it can be tough to keep track of all expenses. However, with VANs, the finance department of a company can set a cap for expenditure as each VAN is attached to one single transaction. For instance, if a company sets up a limit of Rs. 5,000 for a VAN, the person for whom the VAN is intended cannot exceed the limit, and he/she can only spend it during a predetermined fixed time duration that too only after the company authorizes the transaction. Hence, VANs provide businesses a great degree of financial freedom with reduced risks.

Now that you are aware of how virtual account numbers or VAN bank transfers can benefit your business, it is important to be quick in adopting this unique new feature for your business.