Trusted by Top Enterprises & Startups in India

100+ Payment Sources

Flexible Pricing Model

Reach

Smart Retry

High Success Rate

Payment Links

Accept Payments From Multiple Sources

Your customers can set up recurring payments using 100+ payment sources

-

Paytm BankWallet

-

Paytm Postpaid

-

UPI

-

Debit & Credit Cards

-

Net Banking

Reach

Reach 330 million+ Paytm Bank Wallet customers, even in the remotest of locations

Smart Retry

In case of payment failures, Paytm keeps retrying the payment until it is successful

Highest Success Rates Driven by

- 250mn+ saved cards

- 100mn+ saved bank accounts & 15mn UPI ID

- Paytm’s in-house banking infrastructure

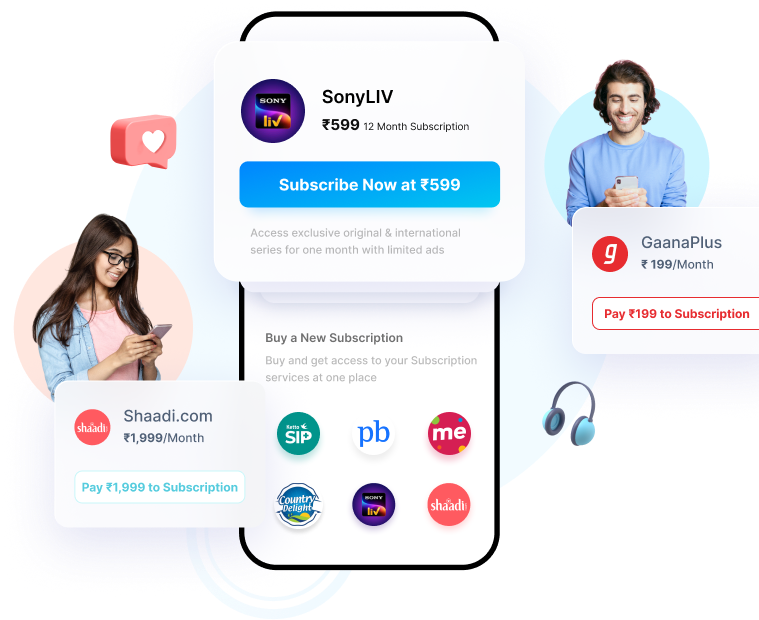

Accept Recurring Payments via Subscription Links

No coding, website or app required. Send payment links to customers directly through SMS, WhatsApp or mail with Paytm Subscription Links

Accept Recurring Payments Through UPI Autopay

- Create & manage mandates either through API or personalised dashboard

- No need for your customers to remember or enter UPI IDs

- Automate payments with UPI Autopay on Paytm, compatible with major UPI apps

- Modify, pause or revoke mandates anytime

Solution for All Types of Businesses

Built for Developers

- Completely customise your customer’s experience using the Custom Checkout Solution

- Best experience for your app users with All-In-One SDK

- Fastest Integration with Paytm Standard Checkout

- Seamless Checkout experience via QR code for TV Apps

Subscription payments are meant for services/products that are consumed on an ongoing basis and for which payments are to be made (as recurring payments) at fixed intervals without any explicit payment action at the customer’s end.

Merchants with recurring payment business models like OTT platforms, Utility Bill payment providers, Edutech companies, BFSI companies in Lending, Insurance, Investment, Credit Card payments space, and more require their customers to pay them periodically. Paytm Subscriptions helps them provide the most seamless experience to collect recurring payments automatically from their customers.

No. You will need to trigger the Renew Subscription API with the subscription ID provided at the subscription creation time. After that, the customer gets debited, and we share an acknowledgment with you. This renewal trigger is to be sent by the merchant, and the customer needs no intervention in the renewal process.

Get in touch

Sorry

We are experiencing some issues. Please try again later